BLOG

Navigating Perth's Property Market: Insider Tips for High-Growth Returns

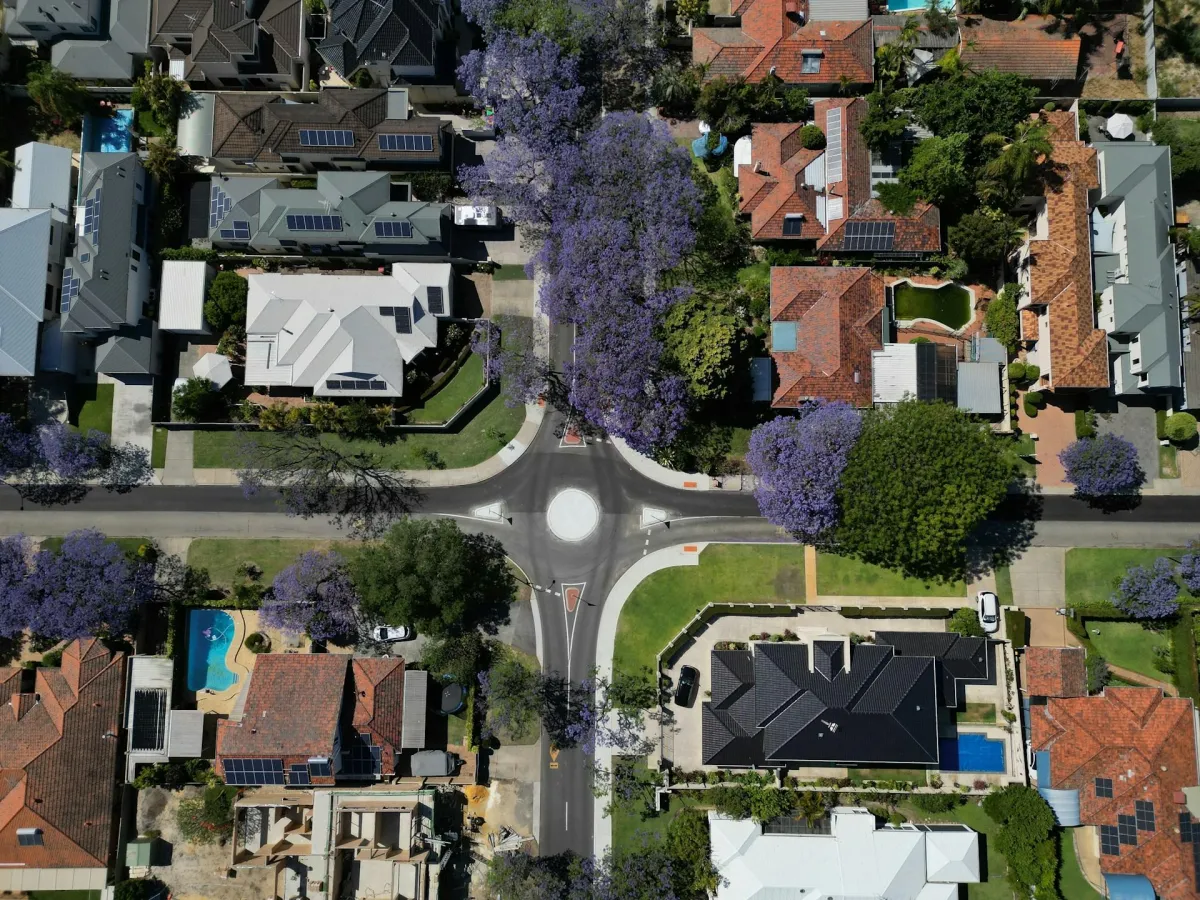

If you're considering investing in property, Perth may not be the first city that comes to mind. However, this hidden gem on the west coast of Australia is quickly becoming a hot spot for real estate investment with its steady growth and high returns.

With so many options and opportunities available, it can be overwhelming for investors to navigate this market effectively. In this article, we'll share insider tips and strategies to help you make the most out of Perth's property market and achieve high-growth returns. Let's dive in!

Understanding High-Growth Returns

High-growth returns in the property market refer to the increase in the value of a property over time, resulting in a higher profit for the investor. This is an essential factor to consider when investing in real estate, as it determines the success of your investment.

In the Perth property market, high-growth returns are influenced by various factors such as location, population growth, and economic stability. For example, a property located in a popular and well-developed area like the coastal suburb of Cottesloe is likely to experience high-growth returns due to its desirability and constant buyer demand.

Insider Tips for High-Growth Returns in Perth's Property Market

To achieve high-growth returns in Perth's property market, conducting thorough research and having a solid understanding of the local market is crucial. Here are some detailed insider tips to help you navigate Perth's property market and maximise your returns:

Focus on Emerging Suburbs

When it comes to investing in property, location is key. While established and popular suburbs may seem like safe bets, focusing on up-and-coming areas can often lead to higher growth returns. These suburbs may still need to be well-known but show potential for future development and growth.

For example, the suburb of Ellenbrook in Perth's north-east has experienced a 37% increase in property values over the past five years, making it a standout performer for high-growth returns. This growth can be attributed to the area's increasing population, new amenities, and infrastructure development.

Look for Properties with Development Potential

When searching for properties in Perth's property market, look for potential development opportunities. Properties that have the potential to be subdivided or renovated can offer higher growth returns as you can increase the value of the property through improvements and additions.

For example, purchasing a large block of land in a well-established suburb and subdividing it into multiple lots can significantly increase its value and attract buyers looking for smaller, more affordable properties. Similarly, purchasing an older property and renovating it to modern standards can also lead to higher growth returns as the property becomes more attractive to buyers.

Stay Updated on Market Trends

Staying updated on market trends is crucial for investors to make informed decisions and achieve high-growth returns in the Perth property market. This involves tracking changes in supply and demand, interest rates, and economic conditions that can impact property values.

For example, a sudden influx of new developments in a particular area may lead to oversupply and lower property values, making it a risky investment. On the other hand, if there is a rise in job opportunities and population growth in an area, it can indicate potential for future growth and make it a desirable location for investments.

Identify Experts in the Local Market

Identifying experts in the local property market can be a game-changer for investors looking to achieve high growth returns in Perth. These experts, such as real estate agents, property managers, and financial advisors, have extensive knowledge and experience in the local market and can provide valuable insights and guidance to help you make informed decisions.

For example, if you're looking to invest in a particular suburb, seeking advice from a local buyers agent Perth management company specialising in that area can give you insider knowledge on market trends, upcoming developments, and potential investment opportunities. Additionally, having a trusted property manager who can manage your investment properties' day-to-day management can ensure they are well-maintained and attract high-quality tenants.

Consider Long-Term Investment Strategies

When investing in the property market, it's essential to have a long-term investment strategy in place. This means holding onto your property significantly rather than flipping it for a quick profit. While making a fast return may be tempting, it often comes with risks and uncertainties. On the other hand, choosing to invest in a property with the potential for long-term growth can result in significantly higher returns.

For example, purchasing a property in the coastal suburb of Scarborough, which is undergoing significant redevelopment and infrastructure improvements, could lead to high-growth returns. As the area becomes more desirable and attracts more buyers, property values will likely increase over time, resulting in a substantial return on investment for those who hold onto their properties.

Factors That Contribute to High-Growth Returns in Perth's Property Market

In addition to the insider tips mentioned earlier, several other factors contribute to high-growth returns in Perth's property market. These include:

Strong Economic Conditions: Perth's economy is thriving, with a diverse range of industries such as mining, agriculture, and tourism contributing to its growth. This economic stability increases employment opportunities and income levels, making it an attractive location.

Population Growth: Perth's population is expected to reach 3 million by 2030, driven by natural growth and migration. This increase in population leads to a rise in demand for housing, resulting in high-growth returns for property investors.

Limited Supply of Land: Due to its coastal location and geographical features, Perth's limited land supply makes it a highly sought-after location for property investment. This limited supply increases property values, resulting in high growth returns.

Low Interest Rates: Low interest rates make borrowing more accessible and affordable for investors, encouraging them to invest in property. This can increase property demand, drive up prices, and result in high-growth returns for investors.

Conclusion

Investing in Perth's property market can offer high-growth returns for those willing to research and make informed decisions. By focusing on emerging areas, looking for properties with development potential, staying updated on market trends, working with local experts, and adopting a long-term investment strategy, investors can maximise their chances of achieving substantial returns on their investments. Additionally, other factors such as strong economic conditions, population growth, limited land supply, and low-interest rates can contribute to high-growth returns in Perth's property market.